Pursuing higher education is a dream for many, but the rising tuition and living expenses can be a significant hurdle. Thankfully, AU Small Finance Bank Education Loan is here to help you bridge the gap. Whether you're looking to study in India or abroad, this education loan could be the financial support you need to turn your academic aspirations into reality.

In this blog, we'll guide you through everything you need to know about the AU Small Finance Bank Education Loan.

Let's dive in!

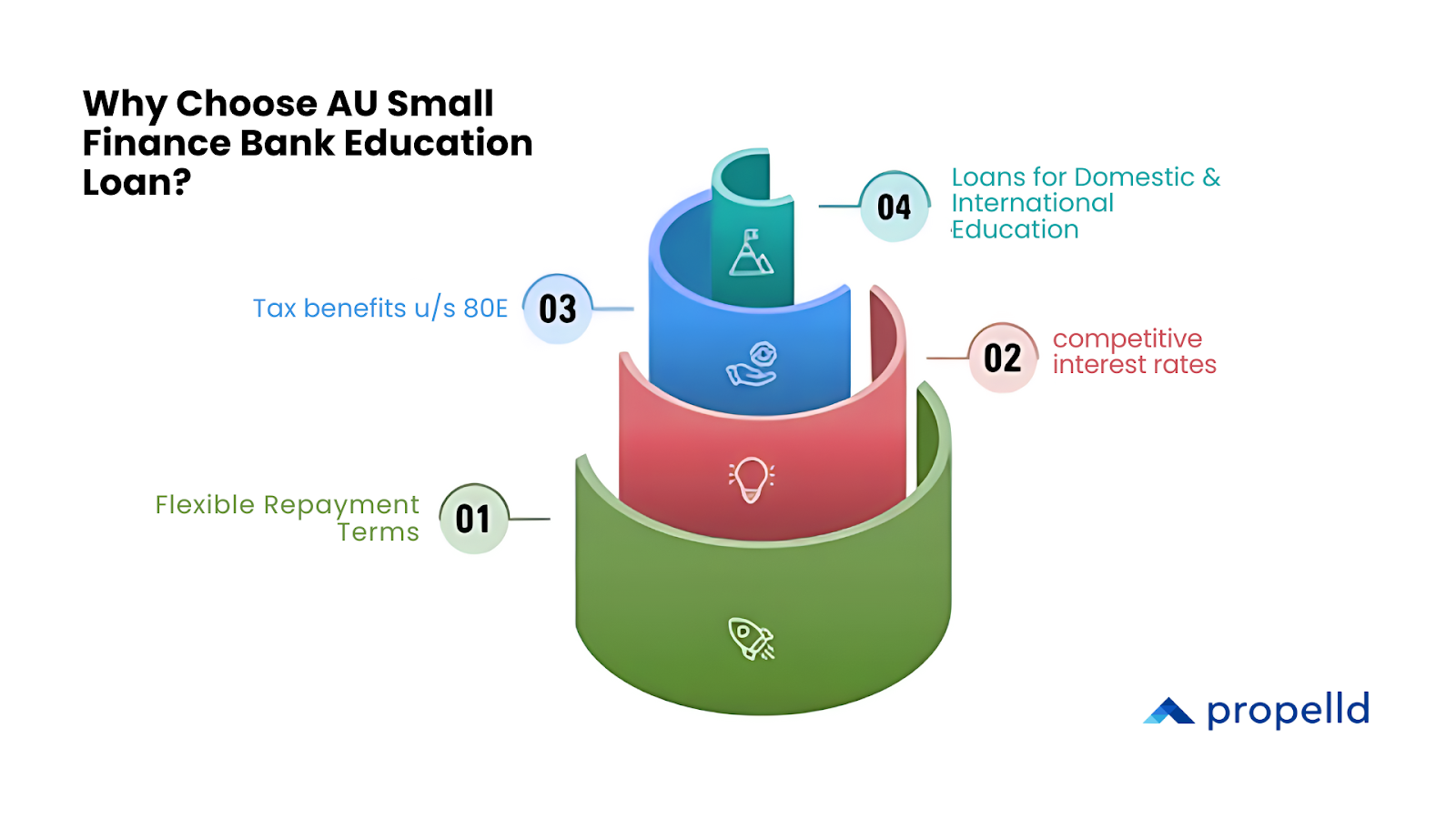

Why Choose AU Small Finance Bank Education Loan?

When looking for an education loan, you’ll want a reliable, transparent bank that offers competitive interest rates. Here's why the AU Small Finance Bank Education Loan stands out.

1. Flexible Repayment Terms

Repay your loan over 5 to 15 years with no penalties for early repayment.

2. Interest Rate Benefits

Enjoy competitive rates based on your academic profile and the institution you’ve been admitted to.

3. Tax Benefits

Claim tax deductions on interest payments under Section 80E of the Income Tax Act.

4. Loans for Domestic & International Education

AU Small Finance Bank has you covered whether you're studying in India or abroad.

One key reason students prefer AU Small Finance Bank is repayment ease, especially during the education loan moratorium period, which allows borrowers time before starting EMI payments.

Also Read SBI Education Loan for MBBS Students: Eligibility & Process.

Get Education Loan 10X Faster than Banks.

Key Features of AU Small Finance Bank Education Loan

Let’s take a look at the key features that make the AU Small Finance Bank Education Loan a solid choice for students:

Eligibility Criteria for AU Small Finance Bank Education Loan

Before applying for an AU Small Finance Bank Education Loan, it’s essential to ensure you meet the bank’s eligibility requirements. Here’s a breakdown of what you need to qualify.

These criteria ensure that you and your co-applicant are financially stable and ready to repay the loan.

Also read Auxilo Education Loan 2024: Interest Rates and How to Apply.

Get Education Loan with Higher Chances of Approval

AU Small Finance Bank Education Loan: Documents Required

To apply for an AU Small Finance Bank Education Loan, you’ll need to submit the following documents:

1. Proof of Identity

Aadhaar card, passport, or voter ID.

2. Proof of Admission

Admission letter from your university or institution.

3. Academic Records

Mark sheets and certificates from previous qualifications.

4. Income Proof

Salary slips or IT returns of the co-applicant.

5. Bank Statements

Latest six months’ bank statements of the co-applicant.

6. Loan Application Form

Fully filled and signed by both the student and the co-applicant.

These documents help the bank assess your eligibility and determine the terms of your loan.

Interest Rates on AU Bank Education Loan

Interest rates play a crucial role when deciding on a loan. The AU Bank education loan interest rate varies based on factors like the type of course, the institution, and the creditworthiness of your co-applicant. Let’s break down the interest rate structure

The interest rate for your loan will largely depend on your course, academic history, and the co-applicant's financial stability. A better credit score and a more robust academic profile may help you lock in a more favorable AU Bank education loan interest rate.

Also Read Bank Of India Education Loan: Interest Rate 2024 & How to Apply.

If you're exploring financing options with AU Bank, you should also know how to get the best education loan interest rates by comparing lenders, credit scores, and repayment flexibility.

AU Bank Education Loan: Fees & Charges

Below are the applicable fees and charges for education loans offered by AU Small Finance Bank:

In addition to the above, certain other charges may apply, such as ECS return charges, bank account change fees, or charges for converting the interest rate (from fixed to floating or vice versa). Applicants are advised to review all these costs carefully before applying for an education loan from AU Bank.

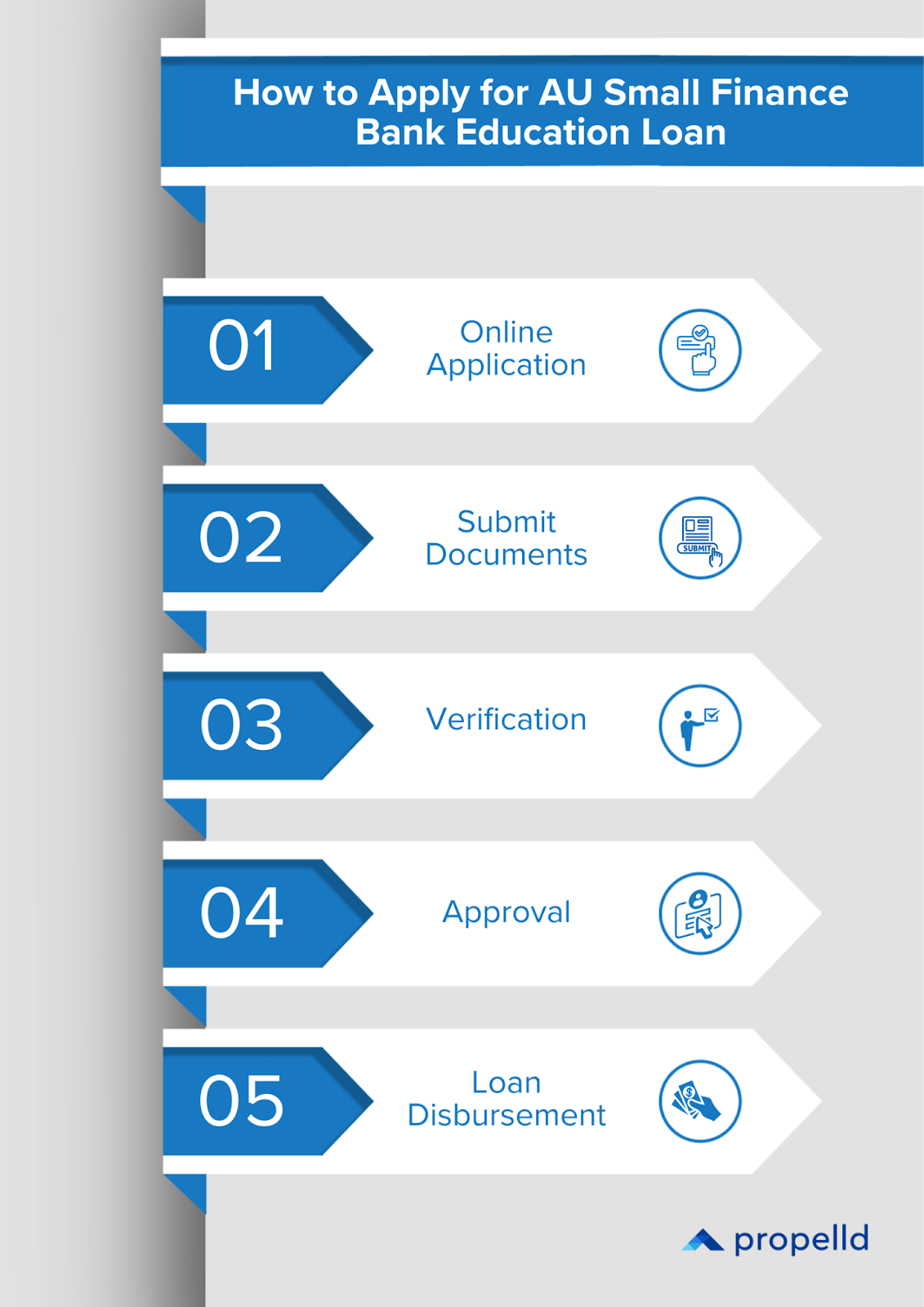

How to Apply for AU Small Finance Bank Education Loan?

Applying for the AU Small Finance Bank Education Loan is a simple and straightforward process. Here’s how you can do it.

1. Online Application

Head to AU Bank’s official website and fill out the education loan application form.

2. Submit Documents

Upload the required documents online or visit a local branch to submit them in person.

3. Verification

The bank will verify your details and your co-applicant’s creditworthiness.

4. Approval

Once everything checks out, your loan will be approved.

5. Loan Disbursement

The loan amount will be directly transferred to the educational institution.

This process is designed to be as hassle-free as possible, so you can focus on your studies rather than stressing over the paperwork.

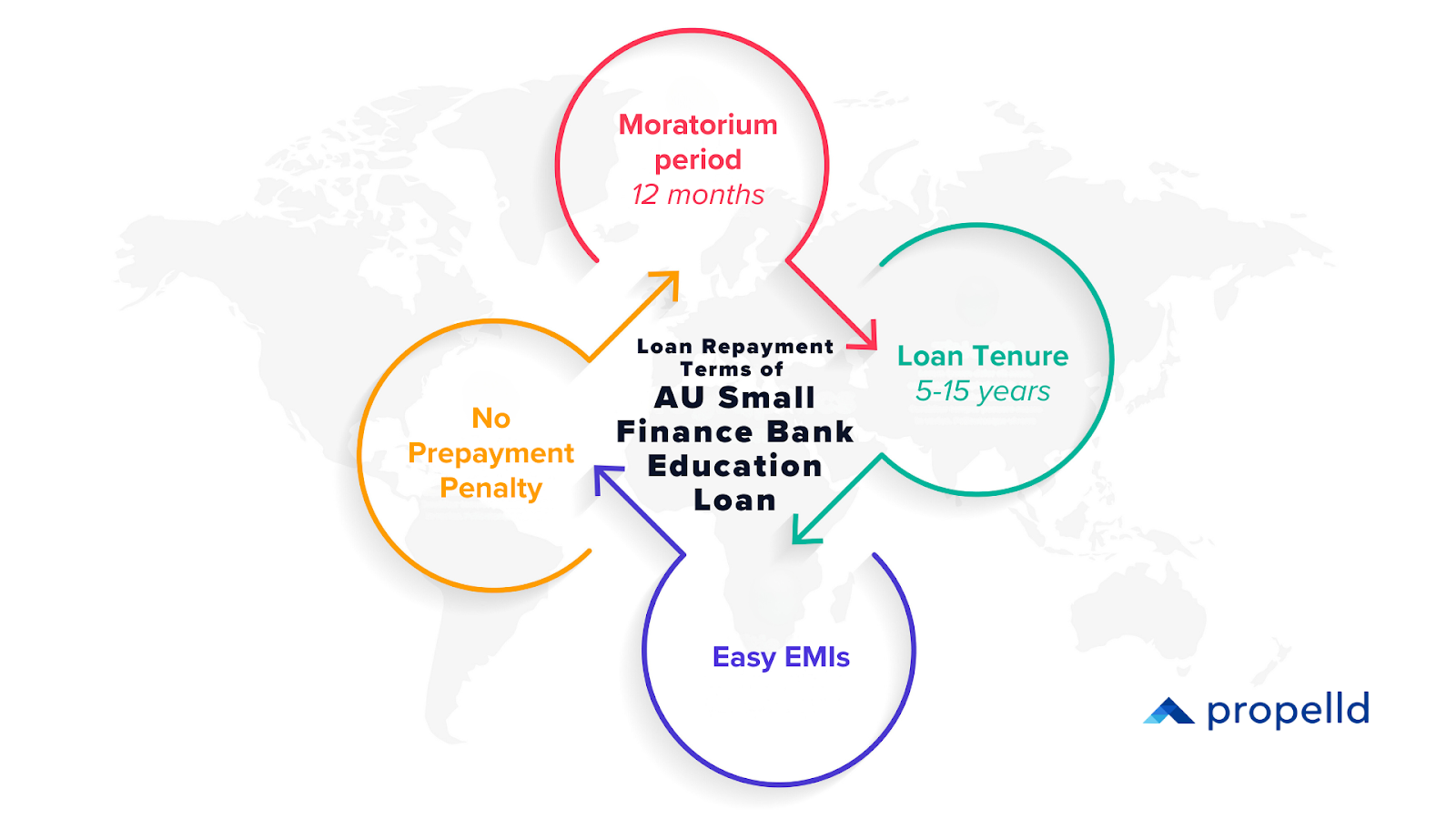

Loan Repayment Terms

Repaying your education loan should not become a burden. AU Bank offers flexible repayment options to ensure you’re not overwhelmed after completing your studies.

1. Moratorium Period

You get a grace period of up to 12 months post-course completion before you start repayment.

2. Loan Tenure

Depending on your financial situation, you can choose a repayment term between 5 and 15 years.

3. Monthly EMIs

Your monthly instalments are based on the loan amount, interest rate, and repayment term.

4. Prepayment Option

Want to clear your loan early? No problem. AU Bank doesn’t charge any prepayment penalties, giving you full control over your loan.

Pros and Cons of AU Small Finance Bank Education Loan

Every loan product comes with its set of advantages and challenges. Here’s a quick look at the pros and cons of the AU Small Finance Bank Education Loan.

Understanding these pros and cons will help you make an informed decision about your education loan.

Also Read our blog, Bank of Maharashtra Education Loan: Eligibility and Interest Rates

Get Education Loan for Any College in India. 100% Fees Financed- Propelld Education Loan

The AU Small Finance Bank Education Loan is a strong contender if you’re looking for financial aid to pursue higher education in India or abroad. With competitive interest rates, flexible repayment options, and tax benefits, it’s definitely worth considering. However, make sure you compare it with other banks to find the best deal for your specific needs. Also, factor in the interest rate, processing fees, and repayment options before making your decision.

Take control of your education finances with Propelld! Our student-friendly loans offer quick approvals, flexible repayments, no collateral up to 50 lakhs, and a lot more!

.svg)