Education Loan for M.Sc Students

Pursuing a Master of Science (M.Sc.) degree is a popular choice among students aiming to specialize in fields like Physics, Chemistry, Biology, Mathematics, Computer Science, and more. An M.Sc. typically spans 2 years and offers both theoretical and practical knowledge, preparing students for research roles, academic careers, or advanced positions in industry.

In India, the cost of an M.Sc. program can range from ₹50,000 to ₹3,00,000 depending on the institution and specialization. Additional expenses for hostel fees, books, lab materials, and other living costs may bring the total to around ₹1,00,000 to ₹5,00,000 or more. Education loans can play a crucial role in bridging this financial gap by covering tuition fees, accommodation, exam fees, study materials, and even travel expenses in some cases.

Key Points

Loan Types: Collateral loans offer lower interest and higher amounts but need security; no-collateral loans have faster approval with minimal paperwork but slightly higher interest rates.

Eligibility: Strong academic record, admission to a recognized M.Sc. program, and a co-borrower with stable income and good credit.

Repayment: Flexible options with moratorium periods during study, followed by EMIs; repayment tenure can extend up to 15 years.

Interest Rates: Domestic loans range from 7.55% to 10%, while international loans typically have higher rates between 10.5% and 13.5%.

Whether you're studying at home or abroad, education loans can make your MSc more accessible. Be sure to compare options, understand repayment terms, and plan your finances carefully.

Unlock Fast, Collateral-Free Education Loans with Propelld Today!

The Ultimate Guide to Education Loans

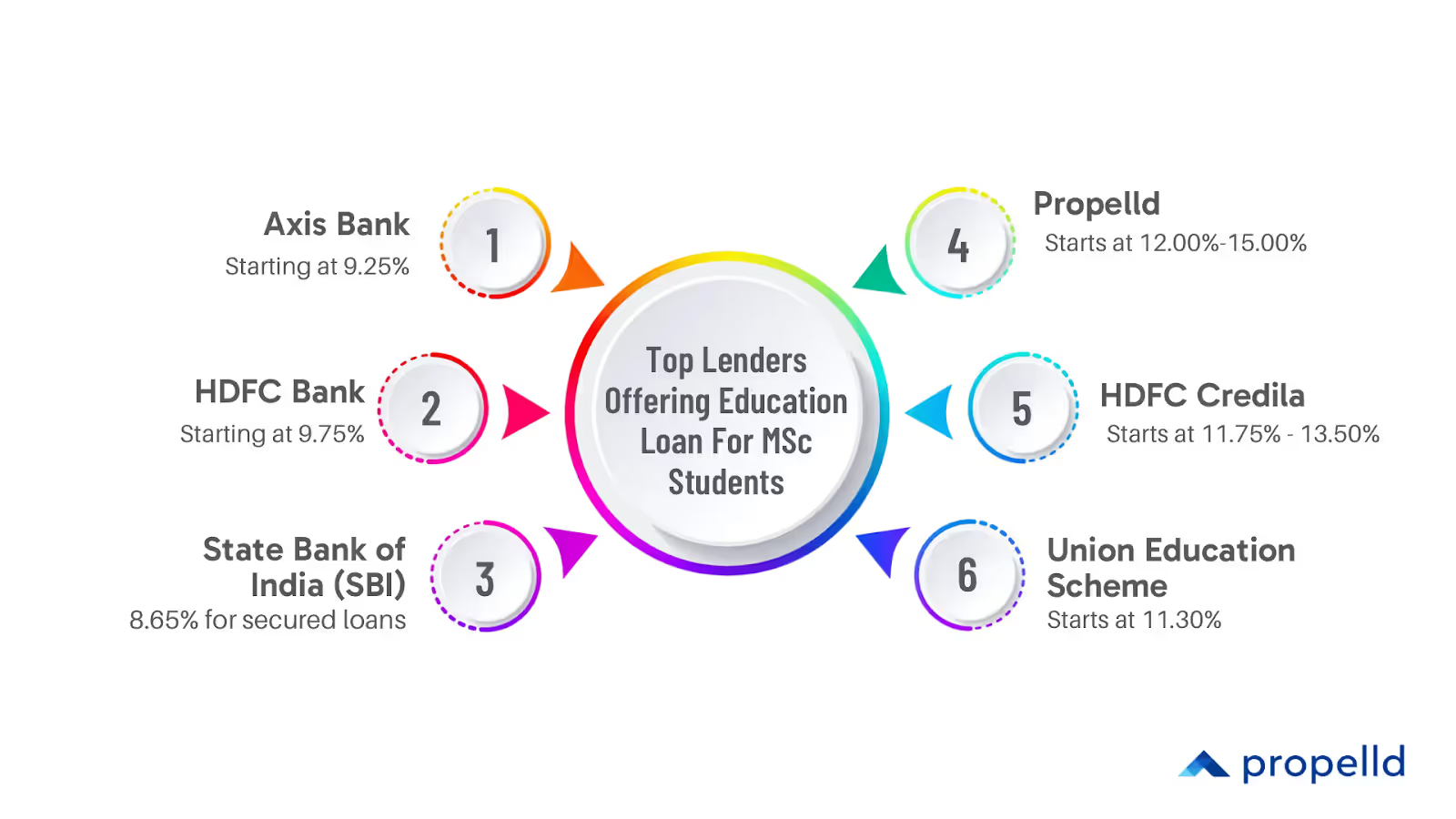

Top Lenders Offering Education Loan For MSc Students

Choosing the right bank or financial institution for your education loan for MSc students is essential. Each lender offers different education loans for MSc students with interest rates, loan amounts, and repayment options.

Top Banks Offering Education Loan for M.Sc Students

Here's a comparison of the top banks and NBFCs in India:

Top NBFCs Offering Education Loan for M.Sc Students

Education Loan For MSc Students Interest Rate

The interest rate of education loans for MSc students significantly determines how much you'll repay. Here's a breakdown of education loan for MSc students interest rate based on different types of loans:

While reviewing the Education Loan For MSc Students Interest Rate, keep in mind that tax deductions under Section 80E can ease the effective repayment burden.

Reasons to Get an MSc Education Loan

Here’s why taking out an education loan can be a smart move for MSc students.

High Costs of MSc Programs

Pursuing an MSc often comes with hefty expenses that go beyond just tuition. Think about laboratory fees, research materials, specialized equipment (especially for STEM fields), living expenses, health insurance, and study supplies. These costs can add up quickly, making financial support a necessity for many students.

Accessing an education loan not only helps cover these expenses but can also make attending top-tier institutions a reality.

Access to Top Universities

Education loans can be the key to studying at prestigious universities that might otherwise feel out of reach financially. These institutions often charge higher tuition due to their cutting-edge research facilities, renowned faculty, and extensive resources. Plus, many employers offer tuition reimbursement, which can ease the financial strain in the long run.

Flexible Payment Options

Education loans come with repayment plans designed to ease the financial burden, offering flexibility to suit different financial situations:

- Moratorium Period: Postpone repayments until after graduation.

- Interest-Only Payments: Pay just the interest while you’re still in school.

- Income-Based Plans: Adjust payments based on your income after graduation.

- Extended Repayment Terms: Spread payments over a longer period to lower monthly costs.

With thoughtful planning and the right loan terms, pursuing your MSc doesn’t have to feel out of reach financially.

Who Can Apply for MSc Education Loans

To qualify for MSc education loans, applicants must meet specific academic and financial criteria. Here's a breakdown of the key requirements.

To know Who Can Apply for MSc Education Loans, check the basic eligibility conditions including academic merit, admission status, and co-borrower profile.

Grade Requirements

Lenders prioritize academic achievements over credit scores:

- A strong undergraduate academic record

- Admission to an accredited MSc program

- Consistent performance throughout your educational history

Co-borrower Requirements

Having a co-borrower can boost your chances of approval.

In addition to academic and co-borrower qualifications, lenders also consider age and citizenship.

Age and Citizenship Rules

Age Requirements:

- Applicants must be between 18 and 35 years old. If under 18, a legal guardian must apply on their behalf.

Citizenship Criteria:

- For domestic loans, the applicant must be an Indian citizen.

- International students may need a U.S. citizen or permanent resident as a cosigner.

- Valid ID and residency proof are mandatory.

Lenders aim to simplify the application process, keeping documentation minimal but maintaining high standards.

MSc Education Loan Types

When financing your MSc studies, it's essential to understand the different types of loans available. Here's a breakdown of the main loan categories and their key features, building on the eligibility and repayment details discussed earlier.

Collateral and No-Collateral Loans

Once you've grasped the application requirements, it's time to explore how collateral and no-collateral loans can align with your financial situation. Each option caters to specific needs.

For those seeking quicker approval and reduced documentation, no-collateral loans are an attractive choice, though they may require a creditworthy co-applicant. On the other hand, collateral loans typically offer better terms but demand assets like real estate, fixed deposits, government securities, or insurance policies as security.

Indian vs. International Study Loans

Your choice of study destination - domestic or abroad - plays a significant role in determining the loan terms.

International study loans often come with stricter eligibility criteria, such as a GRE score of 300 or higher, a co-applicant with a CIBIL score above 700, and admission to a recognized institution.

Both domestic and international loans cover essential expenses like tuition, accommodation, study materials, and other education-related costs. Selecting the right loan depends on your program's location, your financial resources, and your ability to manage repayments over time.

How to Get an MSc Education Loan

Securing an MSc education loan doesn’t have to be overwhelming. Here's a straightforward guide to help you navigate the process:

Compare Loan Options

When shopping around for loans, focus on these critical factors to make an informed decision:

Once you've compared your options, gather the necessary documents to speed up the application process.

Required Documents

Having all the required paperwork ready is crucial for a smooth loan approval process. Here's what you'll need:

Academic Documents

- Undergraduate degree certificate

- Class X and XII mark sheets

- Test scores (GRE, GMAT, IELTS, or TOEFL)

- Admission letter from the university

- A detailed cost estimate provided by the institution

Financial Documents

- Bank statements from the last 6 months

- Co-applicant's income proof

- A statement of assets and liabilities

- Tax returns for the past 2–3 years (for the co-applicant)

Identity Verification

- Government-issued photo ID

- Proof of residence

- Recent passport-sized photos

- Passport copy (especially for international studies)

Approval and Money Transfer

The timeline for loan approval varies. Unsecured loans are typically processed within 2–14 days, while secured loans may take 1–6 weeks. First-time borrowers may need to allow up to 30 additional days for verification.

To avoid delays, submit a complete application with all documents properly self-attested. Stay on top of your loan status by monitoring updates and responding quickly to lender requests. Additionally, confirm details about fund disbursement, including direct transfers to the university and currency conversion for international programs.

Fast-Tracked Education Loans with Propelld – Funding your Future in Just 7 Days!

Education Loan for M.Sc Repayment Plans

Before taking an education loan for a Master of Science (M.Sc) degree, it’s important to understand the various repayment plans available. The table below highlights common repayment options, including details about moratorium periods and typical repayment durations.

When planning your Education Loan for M.Sc Repayment Plans, understanding the moratorium period helps in managing finances before EMIs begin.

Get Education Loan for Any College in India. 100% Fees Financed – Propelld Education Loan

Pros and Cons of MSc Education Loans

Following our earlier discussion on loan options and repayment plans, let’s dive into the advantages and challenges of taking out an MSc education loan.

Benefits

MSc education loans come with a range of perks for students aiming to advance their education:

These loans make it possible to pursue quality education without depleting family savings. The added benefit of a moratorium period allows students to focus entirely on their studies before repayment begins.

Challenges

However, MSc education loans come with their share of difficulties:

Higher Interest Rates

Both federal and private loans often come with fixed or variable interest rates, which can be particularly high for unsecured loans. Interest typically starts accruing immediately, leading to a larger total debt. Notably, over 75% of private loans for graduate students require a creditworthy cosigner.

Career Limitations

The pressure of large loan repayments may push graduates toward higher-paying jobs, potentially limiting their ability to pursue career paths that align with their passions or long-term goals.

Limited Relief Options

Private student loans often lack the flexibility of federal loans. For instance:

- They don’t offer income-driven repayment plans.

- Financial hardship options are usually restricted.

- They don’t qualify for programs like teacher loan forgiveness.

- Discharging them through bankruptcy is nearly impossible.

While MSc education loans open doors to advanced degrees, they also come with financial responsibilities that require careful planning and consideration.

Not with Propelld! Yes, You Don’t Need Collateral for an Education Loan with Propelld.

Summary

This section highlights the key points about MSc education loans covered earlier. These loans provide critical financial support for pursuing advanced degrees, with the average graduate student debt amounting to 88,220. Below is a quick comparison of loan options and their main features:

When deciding on an MSc education loan, keep these factors in mind:

- Funding Options: Federal loans often offer advantages like income-driven repayment plans and potential loan forgiveness. You can borrow up to 20,500 annually through these programs.

- Repayment Flexibility: Look for loans with moratorium periods and repayment structures that align with your post-graduation financial plans.

- Borrowing Costs: Only borrow what you truly need to reduce the interest burden. Studies show that having a cosigner can boost approval chances by 3.5 times.

While longer repayment terms can make monthly payments more manageable, they also increase the total interest paid over time. Consider your future earning potential carefully when choosing loan terms to ensure your repayment plan is sustainable. For more detailed information on eligibility, loan types, and application steps, refer back to the earlier sections.

.svg)